|

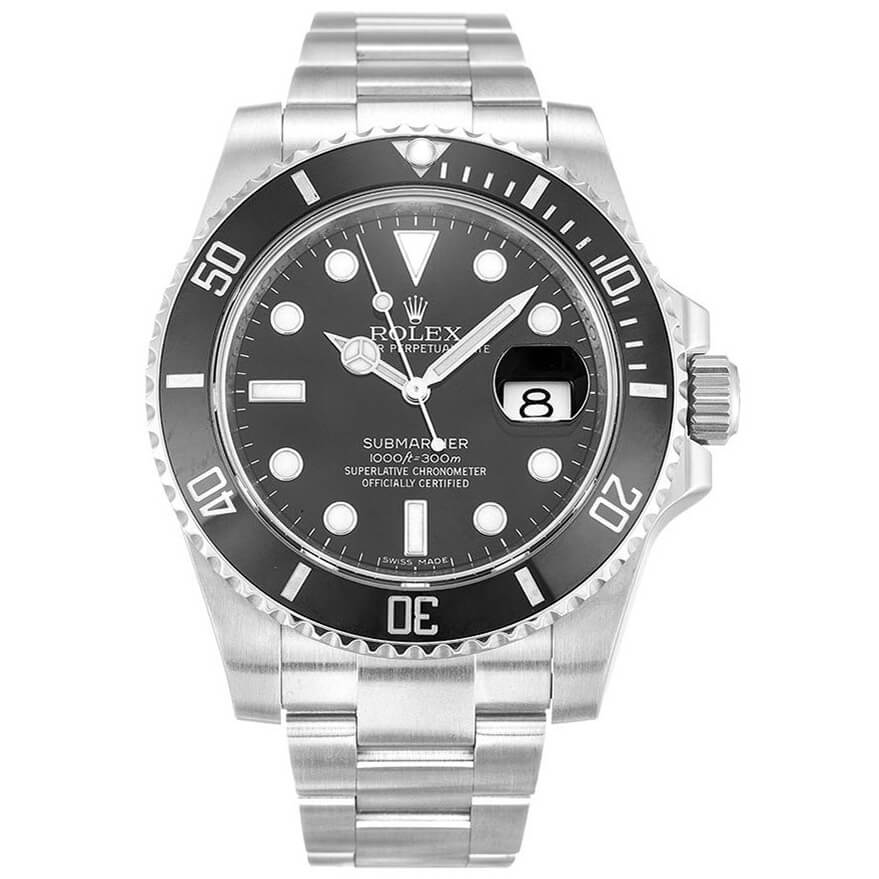

Nell'ultimo numero, abbiamo presentato diversi orologi Rolex per il primo acquisto. Se pensi che gli orologi introdotti in precedenza siano replica orologi italia molto ordinari, oggi ti consiglierò diversi orologi Rolex replica di successo e popolari. Le funzioni di questi orologi sono molteplici. Il suo design ha le sue caratteristiche. Quindi, diamo un'occhiata a questi orologi replica. Replica Rolex Submariner 116610LN Questo orologio è uno degli orologi replica di successo degli orologi subacquei Rolex. La serie Rolex Submariner è sicuramente la migliore in fatto di orologi. Il display superluminoso è anche una delle maggiori caratteristiche di questo falso Rolex. Il quadrante da 40 mm è adatto a tutti i tipi di orologi. Questa imitazione dell'orologi può essere utilizzata in una varietà di occasioni e può anche essere abbinata a vari vestiti. Gli orologi in acciaio inossidabile hanno un'elevata durata. Non è solo resistente all'attrito ma anche resistente alla corrosione. Inoltre, questo perfetto orologio clonato ha anche un alto grado di precisione. Pertanto, se si desidera acquistare uno speciale orologi Rolex replica, questo orologio è molto adatto. Rolex Replica Explorer II 216570WSO

Il design integrato di cinturino, corona e cassa conferisce a questa replica di orologi prestazioni migliori. La precisione e la resistenza agli urti dell'orologi sono garantite. Questo orologi ha lancette luminose e indici delle ore di lunga durata. Pertanto, la funzione di questo orologi è molto potente. L'orologi replica ha tutti gli elementi classici del Rolex tradizionale. Il puntatore del secondo fuso orario arancione retrò è l'esistenza più classica di questo orologi . Il quadrante bianco è semplice. Il puntatore con il bordo nero punta chiaramente. La lunetta fissa spazzolata è solida e pratica. Non è esagerato dire che questo orologi ha una bellezza mozzafiato. Questo orologi è un orologi sportivo, ma ha un'atmosfera elegante. Pertanto, si può dire che questo orologi esatto sia un orologi versatile.

0 Comments

Qual è l'orologi di maggior successo e popolare tra gli orologi Rolex? Deve essere Daytona e Submariner in Rolex. Penso che tutti siano d'accordo con replica orologi italia questa risposta. Queste due serie di orologi sono i due orologi più unici tra gli orologi Rolex. Oggi presenteremo due orologi rappresentativi in due serie: Submariner 116610LV e Cosmograph Daytona 11509. In effetti, molte persone esitano ad acquistare orologi Rolex falsi perché non sanno quale orologio acquistare. Successivamente, presenterò in dettaglio questi due splendidi orologi Rolex. Rolex Replica Daytona e funzione Submariner Come un classico orologi Rolex, si può dire che la replica Rolex Submariner sia un nome familiare. Il Submariner 16610LV è stato follemente ricercato dai fan di Rolex per il suo design audace ed eccezionale sin dal suo lancio nel 2010. L'orologi replica Rolex Daytona è un orologi famoso nel mondo. Non c'è dubbio che sia un altro classico della replica di orologi Rolex. Originariamente era legato alle corse. In effetti, è l'orologio cronografo più professionale sotto il marchio Rolex. Ma se vuoi chiedere quale orologio è meglio, se sei un appassionato di immersioni, allora Submariner è decisamente migliore, se ti piacciono di più gli sport motociclistici, allora Daytona è migliore. Naturalmente, se apprezzi di più la combinazione di colori audaci del Submariner, questa è un'altra questione.

Replica Rolex Daytona e Submariner Design Si può dire che il colore verde degli orologi Submariner sia l'anima dell'intero orologio. La lunetta verde, il quadrante verde e il materiale in ceramica aggiungono consistenza a questo orologio. L'imitazione dell'orologio Daytona non è personale come il Submariner. È un semplice colore argento-nero brillante. Il design e la collocazione di questo colore sono semplici ma classici. Nel quadrante sono presenti tre piccoli quadranti neri. Il design generale del quadrante sembra individuale ed elegante. Non hai bisogno di un qualsiasi altro orologio ordinario. Hai bisogno di un orologio che sia stato testato più e più volte. Un orologi che ha visto la storia in divenire. La replica della cassa in acciaio inossidabile Cartier Tank Mc Brown è quella che replica orologi italia è stata indossata da grandi uomini. Quello che ti serve è l'orologio Cartier Tank Mc Brown in acciaio inossidabile. Questo orologio parla di orgoglio e decenza e chiunque lo indosserà prova sempre un senso di orgoglio e onore. Perché non indossano un orologio, indossano la "storia". Storia del carro armato Mc Brown Cartier Gli orologi Cartier Tank furono introdotti sul mercato da Louise Cartier nel 1919. Le linee delle proporzioni trovate nell'orologi Cartier sono simili a quelle trovate nei Tanks della prima guerra mondiale. Da allora, l'orologi ha "visto" la storia in divenire. La Cartier ha visto la caduta di Hitler e del fascismo in Germania. Ha anche visto grandi momenti storici come la caduta dell'Unione Sovietica e la caduta del muro di Berlino in Germania. È questa storia che ha reso caro il Cartier ai ricchi e potenti della società. L'orologi era uno dei preferiti della principessa Diana e di altre celebrità come Jackie Kennedy e Saint Laurent. L'orologi da polso Cartier ora si vanta di essere l'orologi più ambito al mondo. Tuttavia, un orologi originale potrebbe essere così costoso, non è necessario rapinare la tua banca, una replica con quasi le stesse caratteristiche dell'orologi originale è la tua migliore alternativa. Avrai un bell'orologi ad un prezzo accessibile.

Allora quali sono le caratteristiche che rendono questo orologi un capolavoro? Resistente all'acqua Ci sono orologi che perdono la loro funzionalità non appena entrano in contatto con l'acqua. Questo non è tuttavia il caso dell'orologi Mc Brown Cartier. Questo è un orologi resistente all'acqua e non devi preoccuparti che non funzioni quando piove per alcuni secondi. Una faccia marrone La prima cosa che le persone notano quando guardano il tuo orologi da polso è il quadrante. Il volto di un orologi replica Mc Cartier dovrebbe parlare di splendore e glamour. Questo è ciò di cui parla il Cartier Tank Mc Brown. È disponibile in un colore attraente e proprio sopra c'è il marchio "Cartier". In cima allo sfondo, ci sono numeri romani che sono stati un marchio di fabbrica dell'orologi Cartier per secoli. Potresti imbatterti in orologi Cartier che hanno numeri numerici anziché romani. L'alta probabilità che si tratti di un orologi falso è alta e dovrebbe essere evitata. Il braccialetto L'orologi da polso Mc Brown vanta un bracciale in acciaio inossidabile lucido che è collegato tra loro con fermagli nascosti. La lunghezza è di circa 200*20 mm e questo è sufficiente per adattarsi comodamente al polso. Viene fornito con un vetro in cristallo zaffiro Una delle maggiori differenze tra un Tank Mc e un Tank è il fondello della vetrina. Se il tuo orologi non ha un sistema di movimento realizzato internamente, non ha un fondello in vetro zaffiro. Se ti piace vedere il movimento del tuo orologi attraverso la cassa di vetro, questo è decisamente l'orologi che fa per te. Genere; Maschio Se preferisci un orologi destinato esclusivamente agli uomini, allora è proprio questo. È progettato per gli uomini e questo è un grande vantaggio soprattutto se non ti piacciono le cose unisex. Viene fornito con una splendida finitura Rispetto all'aspetto tradizionale di altri modelli Cartier Mc come la replica svizzera omega, l'acciaio inossidabile Mc Brown conferisce un aspetto più moderno ed elegante. Uno sguardo più da vicino a questo orologi rivela alcune leggere texture attorno al quadrante marrone e questo è davvero impressionante. Omega Seamaster Bullhead quadrante bianco cassa in acciaio cinturino in pelle nera 622825 Replica8/18/2022 Questo è il mio tipo di orologi in movimento! Sono una persona impegnata che vuole solo ottenere tutte le informazioni necessarie in modo istantaneo perché credo davvero che il tempo sia prezioso come un diamante che deve essere replica orologi italia apprezzato e amato. Ogni momento di lavoro equivale al reddito che otterrò ogni mese, ecco perché non devo perdermi nulla anche i più semplici e ogni momento che accade sul mio lavoro deve essere speso solo per i compiti essenziali. Ed è ciò che ammiro davvero di questo orologi facile da usare perché tutte le mie necessità sono già qui al mio polso. Omega Seamaster Bullhead White Dial 622825 Replica mi ha fornito la visualizzazione più precisa di ora e data attraverso le sue parti essenziali con funzioni diverse e uniche ma sorprendentemente offerte a un prezzo basso. Ben prima di acquistare questo straordinario orologi replica, sono fermamente convinto che il prezzo degli orologi di lusso indichi la qualità di un prodotto o servizio che eseguirà. Ma all'improvviso, mi sbagliavo assolutamente con quella convinzione dal fatto che ho acquistato questo segnatempo a buon mercato e ho visto immediatamente l'aspetto lussuoso che mi ha portato come indossatore. La migliore replica Omega in acciaio inossidabile In sostanza, la caratteristica che questo segnatempo può offrire con orgoglio sono le funzioni ergonomiche come un orologi a tutto tondo. Ovviamente, questo orologi potrebbe essere giudicato come un orologi eccessivamente progettato a prima vista. Ma ogni colore e materiale utilizzato su questo orologi ha un determinato scopo e puoi sperimentarlo tutto solo indossandolo tu stesso. Da appassionato fan degli orologi di lusso Omega, devo dire che questo è un accessorio così eccezionale che è il risultato della facilità nello svolgere le mie attività quotidiane perché mi ha fornito tutte le informazioni sull'ora e la data di cui ho urgente bisogno in una frazione di secondo di scansione. Il quadrante dell'orologi ha praticamente presentato indicatori di due ore in modo che chi lo indossa possa intravedere facilmente l'orologi . L'indicatore della prima ora che ha subito catturato la mia attenzione è l'indicatore che mostra le prime 12 ore sul lato sinistro e le successive 12 ore sul lato destro. Ora è molto più facile per me determinare quale sia davvero l'ora perché era chiaramente visualizzata dagli indicatori delle ore e questi indicatori delle ore hanno designazioni a colori. Gli indicatori delle ore di giorno sono colorati su tonalità chiare di blu mentre gli indicatori delle ore di notte sono su tonalità scure di blu. Questo segnatempo non è un normale accessorio che qualcuno indosserà mai perché questo indicatore delle ore è una lunetta interna girevole bidirezionale che ti farà conoscere l'ora delle 24 ore. Solo l'Omega Seamaster Bullhead Replica orologi può offrire una tale perfezione al mestiere dell'orologeria. Ma non è l'unico indicatore delle ore che questo orologi acquisisce. Sotto la lunetta girevole si trovano le 23 strisce di acciaio inossidabile che fungono da indicatore dell'ora secondario. Si aggiunge al radioso aspetto generale del prestigioso Omega Seamaster Bullhead Replica orologi. Controllare la data sul mio telefono o dal calendario sulla mia parete è una tale perdita di tempo. Ecco perché questo orologi è utile e conveniente sul mio lavoro e anche sulle mie attività personali grazie alla visualizzazione della data che mostra accuratamente il giorno del mese sulla 3a ora del quadrante dell'orologi .

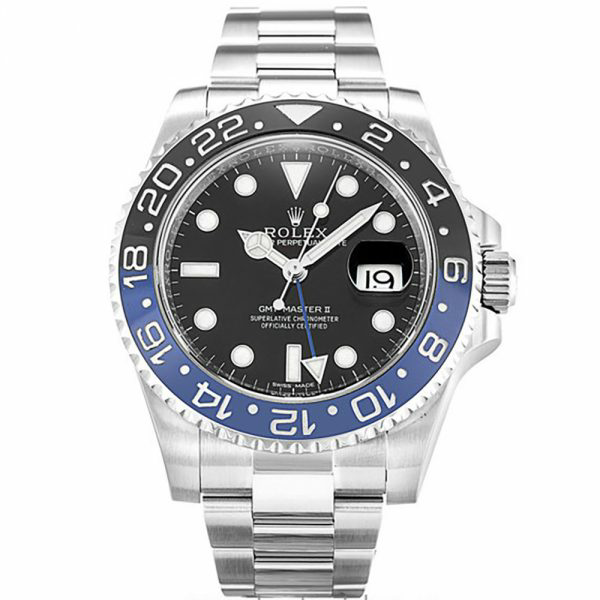

I cronometri vengono acquistati senza altri scopi ma solo per misurare il tempo trascorso. Ma su Omega Seamaster Bullhead White Dial 622825 Replica, tutto ciò di cui avevo bisogno di tanto in tanto è già qui al mio polso! Perché questo orologi ha un cronografo integrato che mi ha permesso di avviare e fermarmi per determinare l'orario preciso tenendo anche traccia dell'ora e della data. Devo dire che sono davvero impressionato dal fatto che questo segnatempo sia molto lontano dalla tecnologia che abbiamo recentemente a causa delle funzioni ergonomiche che ha incorporato in un orologi di lusso e credo fermamente che il marchio di orologi Omega continuerà ancora a fornire lo stato dell'arte collezioni d'arte dell'orologi . A volte, tutto ciò di cui hai bisogno è un buon orologi , uno che si abbini al tuo outfit per farti risaltare. Se questo è ciò che stai cercando, un orologi Rolex ti farà proprio questo. Gli orologi Rolex sono disponibili in design distintivi che non possono mai passare inosservati da qualsiasi appassionato di orologi. L'unico motivo replica orologi italia per cui la maggior parte non possiede questi capolavori è che hanno prezzi molto alti. Tuttavia, puoi procurarti una replica di orologi Rolex come il Rolex GMT Master 11 Blue Black Bezel Replica e ottenere comunque l'aspetto che hai sempre desiderato ottenere. Non è necessario essere uno sportivo per indossare questo segnatempo. Tuttavia, se sei uno sportivo, l'orologi è perfetto. Il knockoff ha un design incredibilmente sorprendente. Specifiche Acquista sempre una replica dopo aver esaminato le funzionalità. Devi anche assicurarti di ottenere l'orologi da un negozio di fiducia per evitare di essere ingannato. Se non sei sicuro di cosa cercare, tagga un amico che conosce gli orologi insieme. In questo modo, eviterai di ottenere un knockoff che si guasta poche settimane dopo l'acquisto. Detto questo, queste sono le caratteristiche dell'orologi di lusso Rolex GMT Master 11 Blue Black Bezel Replica. Il quadrante Questo knockoff presenta un quadrante nero con indici bianchi e lancette delle ore. La lancetta dei secondi è blu con una punta bianca. Il contrasto dei colori ti consente di leggere l'ora sull'orologi con facilità e ti consente anche di vedere l'ora anche in stanze buie. Il logo della corona Rolex viene posizionato sotto l'indicatore delle 12 ore proprio come nell'orologi originale per motivi di autenticità. Anche il nome Rolex viene inciso attorno al quadrante per motivi di originalità. Puoi solo dire la differenza se c'è tra la sua replica e l'originale se sei un esperto in quel campo. L'orologi ha una finestra della data posizionata all'indicatore dell'ora tre proprio come nell'originale. L'apertura della data ha una superficie ingrandita e bianca, caratteristiche che consentono di leggere facilmente la data dall'orologi .

Un vetro zaffiro trasparente racchiude l'orologi consentendo di vedere facilmente il contenuto del quadrante. Il vetro mantiene anche il knockoff al sicuro da acqua e polvere. In quanto rinomato magnate degli affari, il tipo di accessori alla moda che ritraggono il mio valore e la mia dignità sono vitali. Per quanto possibile, appaio elegante ed elegante ma a un costo ragionevole e accessibile. Una volta che avrò orologi replica italia indossato i miei splendidi vestiti abbinati al mio orologi Breitling Bentley con cinturino in acciaio inossidabile con quadrante bianco, sono pronto per affrontare qualsiasi evento. In funzione della disciplina personale, mi assicuro di rispettare i tempi per quanto riguarda qualsiasi programma o appuntamento. Ora, il mio falso orologi Breitling mi ha dato anche la possibilità di mantenere un controllo più attento del tempo. Orologi preciso La precisione dell'orologi è lodevole in quanto la rotazione e il movimento delle lancette presenti sul quadrante dell'orologi sono perfetti. La rotazione è incessante e non è influenzata dall'attrito o da qualsiasi altro fattore ambientale. A causa della natura del mio lavoro, non spendo in modo stravagante in oggetti. Quando un amico mi ha presentato questo orologi in cui potevo acquistare imitazioni di orologi Breitling a prezzi molto convenienti, ho subito afferrato l'offerta. La mia esperienza con l'acquisto di falsi orologi Breitling su https://swissmade.sr è stata positiva. Quadrante attraente e ben progettato Questo orologi di alta qualità ha attirato la mia attenzione mentre navigavo nel sito e non ho potuto resistere a fare un ordine. Il colore bianco attraente e accattivante del quadrante aggiunge visibilità a questo fantastico accessorio di moda. Il mio amore per il colore bianco è in parte responsabile però. Il quadrante è ben progettato e una parte importante che ha avuto la meglio su di me sono state le insegne dell'orologi Breitling, a significare la genuinità di questo orologi Breitling imitato. L'iscrizione "Certifie chronometre" attesta anche il fatto che l'orologi è certificato come un cronometro perfetto e preciso. Il quadrante ha anche quadranti secondari che sono anche responsabili dell'elevata precisione di questo falso orologi Breitling. Uno dei sottoquadranti mostra le notazioni delle ore su 12 ore, mentre l'altro mostra la notazione dei minuti dell'orologi su 60 minuti. Le manopole sul lato dell'orologi aiutano a regolare l'ora. Come mezzo per proteggere il quadrante dell'orologi , la lunetta dell'orologi , dal design accattivante, tiene saldamente il quadrante dell'orologi . Anche il ridimensionamento sul quadrante dell'orologi è reso molto dettagliato e sono ben facili da interpretare. Questo è uno dei motivi principali del mio eterno interesse per questo orologi .

Orologi durevole realizzato in materiale di alta qualità Un collega sul posto di lavoro si era lamentato del suo calvario e delle sue brutte esperienze con l'acquisto di orologi da polso. L'unica soluzione che potevo offrire era di accennare a questo falso orologi Breitling su Biao.is. Da allora, era stato grato per quanta soddisfazione e lusso continuava a godere di questo prodotto. Tutti vogliono ciò che resiste alla prova del tempo. Parlando di un orologi resistente e duraturo, questo è unico nel suo genere. I materiali utilizzati nella fabbricazione di questo orologi sono ben sofisticati e anche accuratamente progettati. Essendo un orologi di fabbricazione svizzera, dovrebbe essere di uno standard eccezionale. Il materiale in acciaio inossidabile utilizzato per il cinturino rende l'orologi piuttosto attraente. Dal suo sviluppo nel 1952, la replica economica Breitling Navitimer è stata uno dei cronografi più ammirati al mondo e, con alcune recenti aggiunte alla famiglia, Breitling ha introdotto questa fine della gamba di orologeria a un'intera nuova generazione di appassionati di tutto il mondo. Il Navitimer è probabilmente il più iconico di tutti gli orologi da polso breitling. Questo classico del ventesimo secolo rimane popolare nel replica orologi italia ventunesimo secolo, più di 65 anni dopo essere stato lanciato per la prima volta per soddisfare le esigenze di un mercato dell'aviazione commerciale e ricreativo in crescita. Grazie alla regola circolare di diapositive che era in grado di eseguire una serie di calcoli rilevanti per l'aviazione, le recensioni di Navitimer Replica orologi sono state adottate dai piloti e in particolare favorite dai proprietari di aeromobili e dall'Associazione dei piloti. Immediatamente riconoscibile, questa volta il design di Chronograph è tanto accattivante oggi come quando è stato introdotto. Sono passati più di 85 anni da quando Breitling ha introdotto il primo cronografo moderno, la cui influenza sul design dell'orologi è stata incalcolabile. Con la sua nuova replica di Breitling Breitling Breitling Chronograph RATTRAPANTE 45, con la sua interpretazione di una delle più grandi complicazioni di orologi, il marchio ha dimostrato che rimane all'avanguardia dell'innovazione. Il cronografo Navitimer B03 Rattrapante 45 ha una custodia in oro rosso di 18 K ed è dotato di Calibro di fabbricazione di Breitling B03, un movimento unico a due secondi protetto da due brevetti. La sua costruzione innovativa garantisce la massima precisione, robustezza e affidabilità.

Il rattrapante è una delle complicazioni più sofisticate in tutta l'orologeria. La caratteristica di Rattrapante nella nuova replica Breitling 1: 1 Breitling Navitimer B03 Chrono Graph Rattrapante 45 è davvero molto speciale, e ci sono alcuni dettagli aggiuntivi che definiscono questo orologi come un istante come istante classico. Il cronografo Navitimer B03 Rattrapante 45 è esteticamente impressionante quanto tecnicamente sofisticato. Ospitato in una grande custodia in oro rosso da 18 k di 45 k in grassetto, si distingue da un quadrante grigio Stratos. Cheap Breitling Replica introduce una capsule collection di cronografi ispirata a tre iconiche auto sportive americane degli anni '60: la Chevrolet orologi replica italia Corvette, la Ford Mustang e la Shelby Cobra. Animati con colori vivaci e un'atmosfera retrò distintiva, il quadrante e il fondello di ogni cronografo presentano il logo di ogni auto sportiva. Il Top Time Replica orologi China presenta un quadrante rosso da corsa e quadranti neri. L'orologi Chevrolet Corvette misura 42 mm, ha un'altezza di 13,65 mm, ha uno spintore a pistone ed è impermeabile fino a 100 metri. Scala tachimetrica nera con scale arancioni e gialle da 400 a 1000 che incorniciano il quadrante rosso brillante e tre sottoquadranti neri leggermente incassati: contatore dei 15 minuti alle 9, contatore delle 6 ore alle 6 e piccola lancetta dei secondi al 3 in punto.

Le lancette delle ore e dei minuti e gli indici delle ore sono trattati con rivestimento luminoso Super-LumiNova e il logo dell'auto è raffigurato sotto la scritta bianca Breitling Best Replica orologi a mezzogiorno. La Ford Mustang condivide le stesse specifiche tecniche della Corvette, con quadrante verde e scala tachimetrica nera con indici arancioni e gialli da 400 a 1000. L'iconico cavallo Mustang compare a mezzogiorno. Non è un segreto che ho un debole per il 2526. Tipo uno grosso. C'è qualcosa di così speciale nella grande cassa a vite con fondello a vite e nel replica orologi movimento a carica automatica di fascia alta. Poi ovviamente hai il quadrante smaltato! C'è così tanto da amare e vediamo sempre in vendita i 2526, quindi è facile prendersela con loro. Quello che stai guardando è un Patek Philippe Replica con cassa in platino referenza 2526 con quadrante in smalto bianco senza diamanti. Ed è firmato Tiffany! E viene fornito su un braccialetto Tiffany in platino, corretto per il periodo! E la condizione è pazzesca! Trovare un platino 2526 è quasi impossibile. Quindi prova a trovarne uno con quadrante smaltato. Si va da migliaia a centinaia a decine a meno di cinque orologi molto, Best Replica orologi italia. Quindi, trovane uno firmato Tiffany. Aggiungi a questo l'incredibile braccialetto di mattoni di platino Tiffany & Co. a grandezza naturale che lo accompagna e avrai quello che potrebbe facilmente essere il 2526 più costoso mai venduto. E non è di Phillips o Christie's, il che lo rende ancora più affascinante. Per coloro che sono interessati a fare offerte, hai 32 giorni per trovare quello che sarà sicuramente un numero importante per gli orologi di lusso, quello che penso sia potenzialmente una delle vere scoperte sul mercato degli ultimi anni. Dai un'occhiata qui sotto ad alcune foto.

I movimenti interni di Breitling alimentano due nuovi orologi della collezione Bentley. L'Avenger Hurricane con la sua cassa "Breitlight" è fatto per replica orologi italia resistere a quasi tutto ciò che si può fare con un orologio da polso. Con l'Avenger Hurricane Breitling introduce "Breitlight", un nuovo materiale per la custodia. È quattro volte più leggero del titanio e molto più duro. “Breitlight” è assolutamente antigraffio, antimagnetico e antiallergico. Indossato al polso "Breitlight" è caldo e non freddo come l'acciaio inossidabile. La sua delicata marmorizzazione sembra buona. Con 50 mm Breitling mostra una cassa enorme, una cassa fatta non per il polso di tutti. L'Avenger Hurricane è dotato di un quadrante 24 ore, è alimentato da un calibro cronografo ETA certificato cronometro ufficiale. L'orologio è impermeabile fino a 100 metri.

Il calibro cronografo Breitling B04 certificato COSC che indica un secondo fuso orario con la lancetta rossa è alloggiato in una cassa in carbonio high-tech da 45 mm. La tecnologia utilizzata per realizzare la custodia proviene dall'aerospaziale e dalla formula uno. Il cosiddetto rehaut del quadrante indicava il fuso orario in tutto il mondo nelle 24 città più importanti legate ai fusi orari. |

AuthorWrite something about yourself. No need to be fancy, just an overview. Archives

December 2018

Categories |

RSS Feed

RSS Feed